You’ll see that this section is much longer in Schedule K-1 (Form 1065) because the IRS wants a lot more information about partners than shareholders. Part II asks for information about the partner or shareholder.Part I asks for information about your company.Here’s what the Schedule K-1 looks like, for Form 1120S: Form 8655 for reporting with respect to foreign partnerships.įortunately, this form is a one-pager.Form 1041 for distributions to beneficiaries of trusts and estates.Work with your certified public accountant (CPA) or other tax professional to see if you need to issue either of these forms for tax filing: There are also other types of Schedule K-1 tax forms. Talk to your accountant to see if this applies to you.

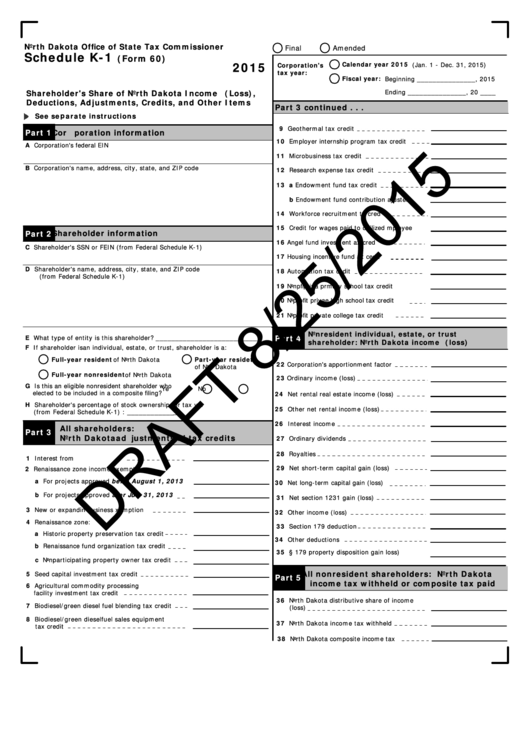

You may also have to fill out a state-specific Schedule K-1 (or equivalent form). If you’re an S corp with shareholders: Fill out Schedule K-1 (Form 1120-S).įor tax preparation, here are the differences between the two forms:Įach partner’s share of the partnership’s income, gains, losses, deductions, credits, and liabilitiesĮach shareholder’s percentage of income, gains, losses, deductions, and credits.Return of Partnership Income): Fill out Schedule K-1 (Form 1065). All types of partnerships need to fill this out, regardless of whether your small business is a limited partnership, general partnership, limited liability partnership, or a multi-member limited liability company.

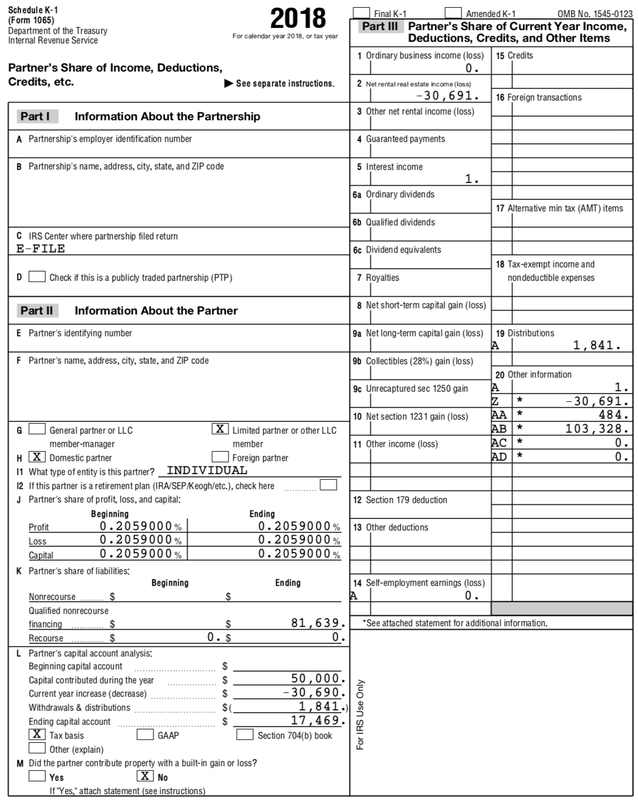

If you’re a partnership filing Form 1065 (U.S.

The right one for you depends on the primary tax form your company fills out: Which Schedule K-1 do I need? Should I complete Form 1065 or Form 1120-S?ĭepending on your business entity type, there are a few different IRS Schedule K-1 forms out there.

0 kommentar(er)

0 kommentar(er)